|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Way to Refinance My Home: Essential ConsiderationsUnderstanding Home RefinancingRefinancing your home can be a smart financial move, but it's important to understand what it entails. Essentially, refinancing involves replacing your current mortgage with a new one, often to secure better terms or interest rates. Why Refinance?There are several reasons to consider refinancing your home:

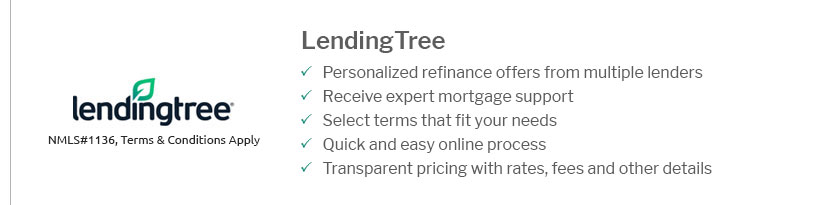

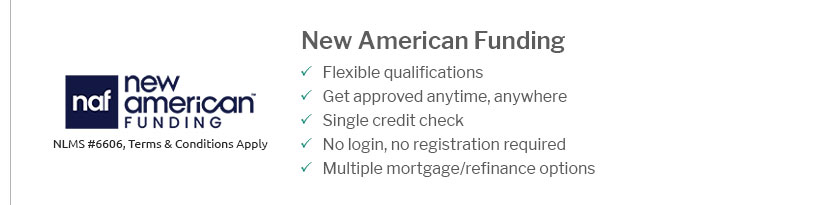

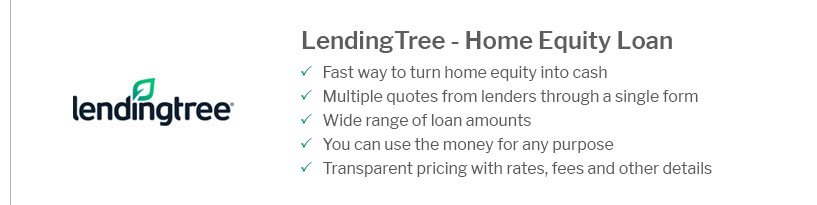

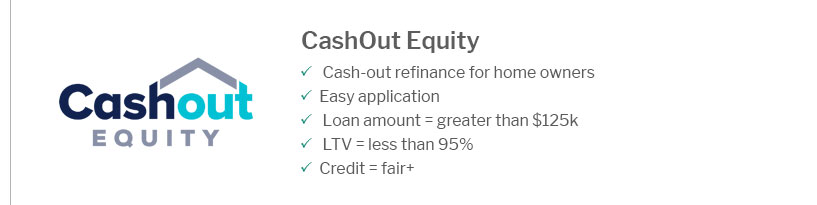

For more insights, explore the best house refinance companies that can offer competitive terms. Steps to Refinancing Your HomeEvaluate Your Financial GoalsBefore refinancing, it's crucial to assess your financial situation and long-term goals. Consider whether the potential savings align with your objectives. Research Lenders and RatesShop around to find the best interest rates on home refinance. Comparing offers from multiple lenders can help you secure the most favorable terms. Prepare Your ApplicationGather necessary documentation such as income verification, tax returns, and credit reports. A thorough application can streamline the approval process. Frequently Asked Questions

https://myhome.freddiemac.com/refinancing/options-for-refinancing

Speak to your lender to discuss your refinance options. Consider meeting and comparing multiple lenders to determine which lender offers the best terms and cost ... https://themortgagereports.com/76288/basic-refinance-requirements

Your current mortgage must be in good standing: If you've skipped any monthly mortgage payments, you'll need to catch up before refinancing ... https://www.reddit.com/r/FirstTimeHomeBuyer/comments/11voyy0/how_to_refinance_home/

Refinancing means you found a new person to lend you money to pay off the first loan. For example: Your original Loan is 300k at 7% interest.

|

|---|